- Market Information

Why Hiring Demand is Set to Surge in 2024

Despite a record 20-year slump in hiring since July 2023, here are 6 reasons why we expect hiring of Asset Management Salespeople to surge.

- June 6, 2024

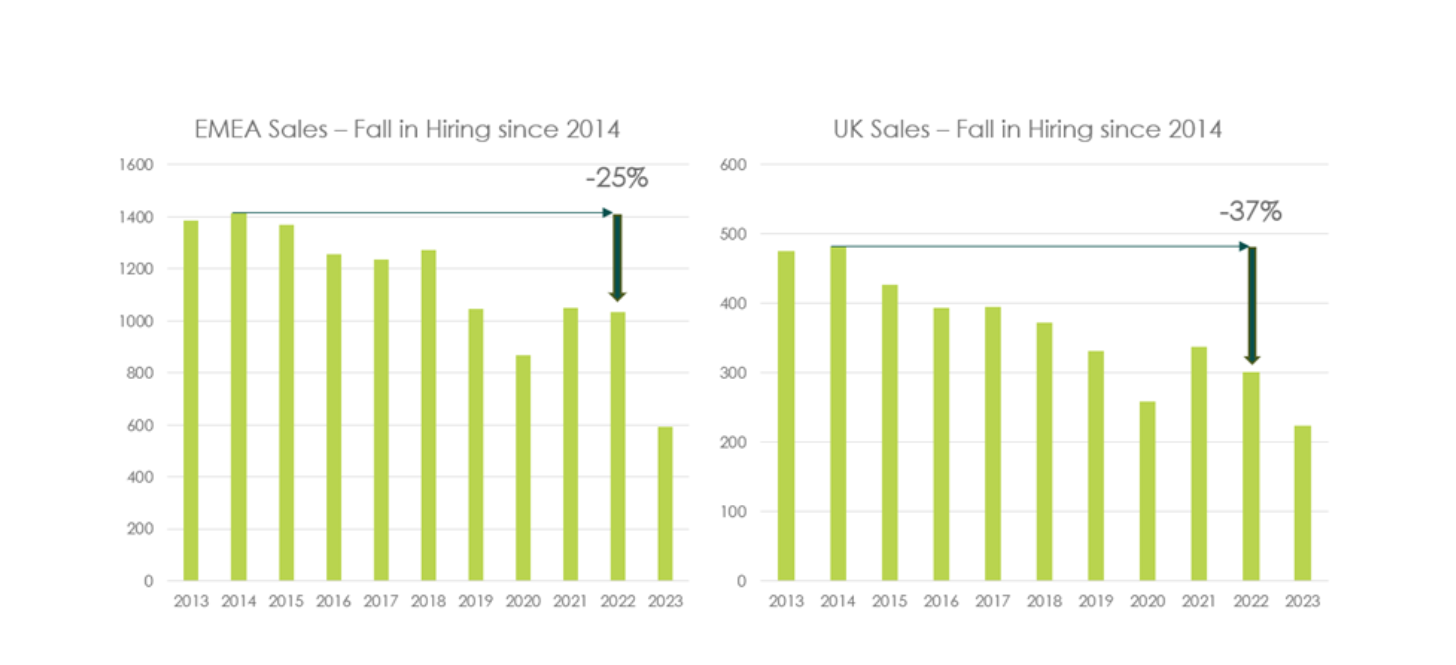

Sales Hires in Asset Management: EMEA vs the UK

Over the past decade, the EMEA region has seen a consistent drop in the hiring of salespeople, with a 25% decrease since its 2014 peak. This excludes the unusual hiring slump last year, the worst in two decades. The UK, however, has experienced a more significant drop of 37%. So, what’s behind this steeper decline?

The industry has indeed been shrinking due to various factors. These include both the strong trend for consolidation of Asset Managers through M&A activity (so, fewer companies to employ salespeople) as well as the consolidation of their natural client base: asset owners, pension funds, and DC mastertrusts. As well as competition from ETF and Index providers. It is also true that the UK’s hiring downturn began in 2015, one year before the Brexit referendum.

But why has the UK’s hiring rate fallen so much more than the EMEA region overall? The Netherlands, structurally similar to the UK from an asset owner/pensions perspective, saw only a 12% decrease in the same period.

We propose that Brexit could be a factor, with hiring shifting from the UK to mainland Europe. And, because the UK comprises such a large proportion of the EMEA asset management sector, when the UK catches the flu, the whole of Europe catches a cold, which may also account for some of the decline in pan-European hiring.

Contact us for more information on how Brexit has impacted on EMEA Sales resourcing.